Construction Industry Performance, Salary and Job Satisfaction Report

Back to All NewsConstruction Industry Performance, Salary and Job Satisfaction Report

Our latest Construction Industry performance and salary analysis contains data on how salaries are holding up in theconstruction industry, job satisfaction levels, and our thoughts on how we think the industry is performing and willperform as we move through 2025 and into 2026.

This last year has seen a whole host of changes both in the UK economy and wider; we’ve had a change of Government and with it a change of direction for many policies and spending plans. The National Minimum Wage (NMW) has increased by 6.7% from £11.44 per hour to £12.21 along with increases in Employer’s National Insurance contributionsand in addition, global US tariffs have been introduced, which could challenge the UK’s growth forecasts and mean UK construction product exports become exposed to tariffs.

We’ve used our own data on salaries on placements we have made between April 2024 and March 2025, on both permanent and contract bases. In conjunction we have carried out some job satisfaction surveys across our social media, and looked at data on vacancies we are working on. We plan to review this information again later in the year to see ifthe NMW and employer contribution increases have had any effect on both wage levels and job satisfaction. We believethis report will help give us a better understanding of our industry, allowing us to continue to improve our service levelsand serve our clients and candidates better.

How is the UK economy and Construction Industry performing?

The forecast for growth in the UK for this year has been downgraded by the OBR from 2% to 1%. However there have been improvements made on growth forecasts over the next four years. The government has also confirmed £13 billion more will be invested in capital infrastructure over the next five years, with an additional £2billion for social andaffordable housing. There will also be £625million spent in England over four years to boost existing schemes to trainworkers in the construction sector, which could provide over 60,000 more skilled workers. We saw a 0.5% rise in construction output in March this year, mainly due to increases in new work and repair and maintenance. However the residential sector started slowly in the first quarter, with falls in project starts, contractawards and detailed planning approvals compared to 2024. The housing market faces uncertainty with increases instamp duty that came into effect in April alongside weakened demand. According to BCIS building costs are expected to rise by 17% over the next five years and tender prices will rise 15%. Businesses are also facing higher employee national insurance contributions, and homebuyers are facing national insurance rises too, leading to potential affordability issues. However the BCIS do forecast that new work output will grow by almost 20% over the next five years.

Outside the housing sector, industrial sector project starts increased and office starts rose sharply, especially projects over £100 million, with an almost 70% increase on last year. Projects between £50million to £100million also increased by 153% (figures according to Glenigan). The hotel sector is showing a strong performance this year, with year on year and quarter and quarter increases on project starts - again projects over £100million have driven this growth. Project starts in Civil Engineering have been poor in the first quarter of 2025, but we are starting to see a strengthening pipeline, and this, along with April’s new AMP8 program and the increase in capital spending should represent a recovery as we move forward.

Whilst there have been ups and downs to the start of 2025, forecasts do suggest that there will be a gradual recovery in housing starts; along with the increase in capital spending, interest rates are now at their lowest rate since 2023, with suggestions of further cuts, which should help boost housing affordability and increase demand. Improved consumer spending should also translate into improved retail and hotel and leisure sector starts. We will be closely monitoring the sector and the impact on salaries and job satisfaction as we move throughout the rest of 2025 and into 2026 and share our findings.

Survey Findings

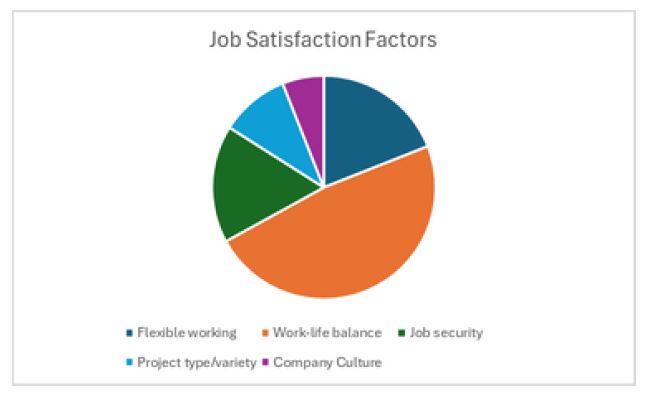

In terms of job satisfaction, previous surveys over the years have always demonstrated to us the importance ofsalary, but also how important other parts of the overall job package are to candidates. We carried out some polls on social media, and what we can see again is how much value people place upon a work-life balance in their roles.

Aside from salary almost 50% of respondents deemed it to be the most important aspect contributing to their job satisfaction. We’ve also seen the importance of flexible working again; around 20% of respondents deemed it to be their priority for job satisfaction aside from salary. Job security plays a fundamental role in the overall satisfaction too - this might be more so given the cost of living increases we’ve endured over the last couple of years.

And are people happy in their role? According to our results only 46% of respondents were, 50% were not and 4% were indifferent. The last survey we did in 2023 showed that almost 80% of people were happy in their role,so this is a significant drop, and there could be many factors affecting this result - our data set is small and might not reflect the overall market; other considerations aside from monetary include things like the company culture,the variety of the projects that people work on, work-life balance, flexible and remote working availability and so on.

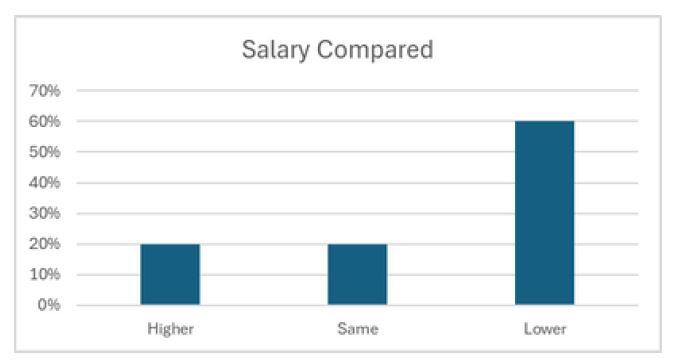

How do salaries compare in similar roles? Our polls showed that around 20% believed their overall remuneration package to be higher than similar roles elsewhere, with 60% believing theirs to be lower. Obviously there will be many factors affecting similar role pay rates, some of which we discuss further on (for example the type of company a candidate works for).

Only 6% believed their salary package was higher than their expectations, 44% said it met their expectations and 50% believed it to be lower than it should be. As we move forward and as the minimum wage increases kick in, it will be interesting to see if this has an affect on people’s expectations of what they should be paid, especially if it means more people are looking for increases as the gap between the NMW threshold and other pay rates reduces. We also need to consider what is happening with inflation in the UK economy; there was an unexpected rise in April to 3.5% because of higher water, gas and electricity bills coming into effect, along with other bills.The Bank of England has said it expects inflation to peak at 3.7% between July and September 2025 before slowly falling. This additional squeeze on the cost of living could affect people’s overall standards of living and create thoughts that their salaries are lower than expected. Once we analyse this later in the year, we should have a clearer picture of what has happened.

Linear Recruitment Permanent Placements

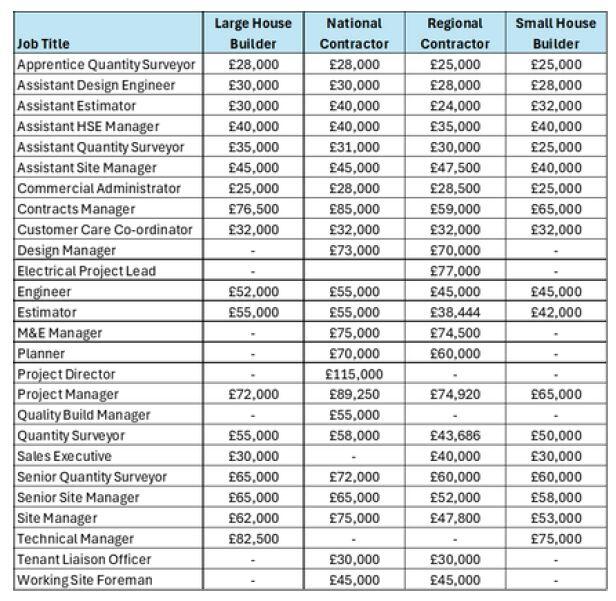

We’ve analysed data on permanent placements we have made over the last year. The data in the table below shows the average salary by job title, split by client type, which we can see has an influence on the salary on offer.

If we look at Contracts Manager positions that we have filled, salaries range from £59,000 for a regional contractor to £85,000 for a national contractor, and similarly with Quantity Surveyors -we’ve placed candidates in roles with national contractors and large house builders with salaries around 30% more than with a small house builder or regional contractor. There’s a similar difference between salaries for Project Managers with a national contractor and small house builder. There are obviously lots of reasons for these variances; when looking at our placement information it should be noted that certain roles have different functions depending on the client sector, which will have an impact on the salary package – i.e. an Estimator role within House Building is different from that within a Contractor. We also need to consider the value and type of projects worked on; the experience that the candidates would therefore need would vary. For example large housebuilders are more likely to work on bigger schemes in terms of the number of units and havehigher completion targets. Essentially bigger contractors/organisations are likely to have more structure to the benefitspackage in general and this would be unlikely to differ per role. We can also see that sometimes we place certain roles onlywith certain types of clients; a reflection of the scale of the construction projects.

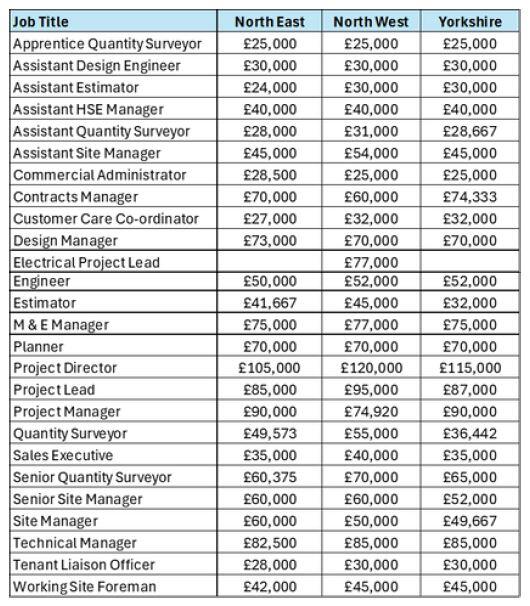

We’ve also looked at regional differences.

The tables above show average salaries split by our main geographical areas that we cover and also average minimum and maximum salary ranges. On the whole, the salaries are similar to what our salary survey and guides indicate, with regional variances accounting for some of the differences, along with the different type of construction companies we work with, as discussed previously.

Linear Recruitment Contract Placements (Non-PAYE)

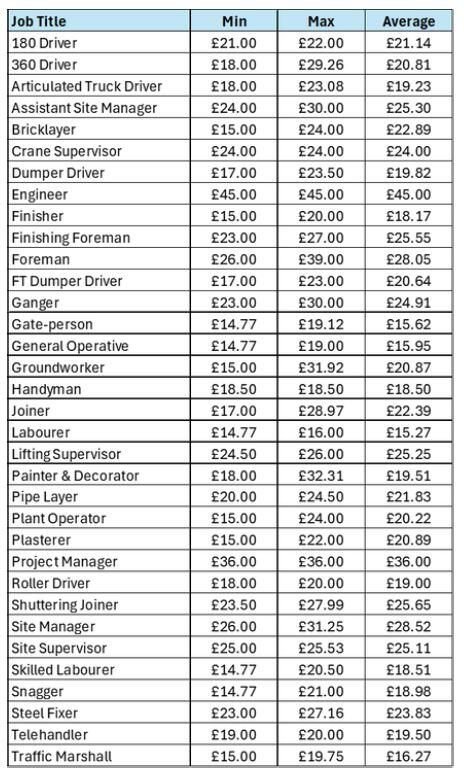

The two tables are showing hourly and day rates by job for some of the non-paye contract placements we’ve made over the last year.

Regarding hourly rates, because of National Minimum Wage increases both last year and this year, the rates have risen significantly compared to previous years. As General Operatives are receiving higher wages, it is having a knock-on effect on other operatives on sites, as they are requesting higher pay as the gap between rates has reduced.We’ve seen rates for roles like Plant Operators remain steady, but we can see things starting to tighten a little as employers’ costs have increased because of the rises in national insurance. If the NMW increases again next year, we think that rates for these sorts of roles will have to rise as the NMW level will become increasingly similar to current Plant Operator pay rates. Day rates have seen a general upward trend over the last couple of years, for example rates for Assistant Site Managers have increased on average by 11%, maximum rates we’ve seen for Site Engineers have increased a staggering 40%, with the average rising by 28%. Minimum rates for Quantity Surveyors have also increased significantly, and Site Manager averages rates have shown an 11% increase. It has been a topsy-turvy last 24 months within the UK economy and the Construction Industry has been no different. 2024 wasa challenging year across the Construction sector with sluggish growth (just 0.4%) on 2023, mainly driven by Repair and Maintenance contracts, whereas new project starts decreased by 5.3%. There were ongoing issues with insolvencies within the sector; in the year to March 2025 construction was the sector with the most insolvencies in the UK, with over 4,100 firms going into administration, liquidation, or company voluntary arrangements, most notably ISG. This has naturally had a significant impacton market confidence and that deeply influenced the Labour & Recruitment market.

Due to the aforementioned challenges, we have seen a depressed demand for permanent recruitment, with organisations reluctant to invest in growing their employee base, so exploring alternative options before automatically attempting to replace departing staff members. Despite this, when companies did indeed look to recruit such staff they found a hesitant candidate market with employees often cautious to risk leaving stable employment, as well as a clear skill shortage, with commercial and technical positions particularly difficult to recruit for. All this has led to relatively minimal growth when it comes to salary increases over the past two years, which, given the increases in the basic cost of living, explains our findings of an increase in the dissatisfaction of our survey respondents when it comes to overall job satisfaction.

Moving into 2025, the not insignificant National Minimum Wage and Employer’s NI increases will have had a significant impact on employers’ baseline costs; this coupled with the uncertainty in general market conditions given the change in Government and unpredictability of the global US Tariff amendments has reinforced this hesitancy to recruit permanent staff but conversely has contributed to an increase in demand for more flexible staffing solutions. We have seen a significant upsurge in requirements for Temporary White Collar staffing in particular, which has subsequently resulted in the evidenced increase in hourly and daily rates for positions such as Site Managers, Site Engineers and Quantity Surveyors. Looking ahead, while 2025 is expected to be a challenging year, with only minimal growth, 2026 is forecast to see a more substantial increase, with Glenigan forecasting 10% growth in Construction project starts, which should give clients confidence to start thinking more long term about their recruitment strategy. Of course, there are other aspects to consider which could affect this confidence, for example the Building Safety Act Gateways has led to significant delays and challenges for developers of higher-risk buildings but notwithstanding there should still be enough confidence in the overall state of the Construction Industry to see continued improvement in demand within the Construction staffing sector. The previously highlighted issues of skill shortages and candidate hesitancy will need to be navigated by those organisations wanting to recruit, with a more dynamic approach to candidate attraction needed along with a more flexible approach on how they engage with, employ and retain staff.

Any such company that wishes to discuss how we can support in such circumstances, Linear Recruitment can offer a fully consultative service, offering guidance on the wider recruitment market, so please don’t hesitate to reach out to one of the team. You can contact us here.